For the past 30 years, academics have been advocating the Efficient Market Hypothesis (EMH) and built many models around this theory to predict the market.

For the past 30 years, academics have been advocating the Efficient Market Hypothesis (EMH) and built many models around this theory to predict the market.EMH essentially posits that the market will always correctly price all assets, and investors cannot make outsize profits to beat the illusive 'market portfolio' over the long run.

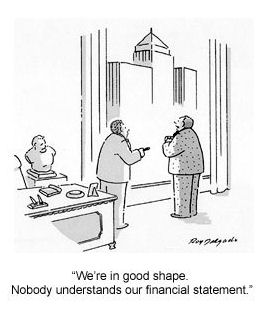

The greatest flaw of this theory is the assumption that humans are rationale regardless of any circumstance, and that institutions with their arsenal of extremely smart professionals will always drive market to become efficient. This cannot be further from truth and most of EMH and its related models have failed miserably in predicting the market.

This is because, human beings are creatures with emotions, built with survival instincts of self-preservation, and no amount of rationality can overcome our instincts. We tend to follow the crowd as that herd instinct gives us the illusion of safety in numbers. We tend to hold on to losers(stocks) as we hope that it will bounce back one day, resulting in much greater losses by selling too late. We tend to sell our winners too early for fear of losing the gains we have made, only to see the stock climb ever higher. To put in bluntly, the 2 greatest drivers of the stock market are actually Greed (Optimism) and Fear (Pessimism).

The Real Price of a Property

To give an illustration of what is Behavioral Finance, imagine you are looking to buy a house in a prime area for your own residential use. You checked out the price of recent transactions for nearby units and also heard from your property agent that price is going for $1000 per square feet (psf). Having this price level in mind, you started searching for a unit that fits your preference. Being highly efficient, your agent immediately found 1 that matches all your requirements. Near a bus and MRT interchange that also have an integrated mall, within 1km of a prestigious school, have amenities like a swimming pool, gym and function room, age of the house is less than 10 years and the unit is very well maintained with friendly neighbors.

To give an illustration of what is Behavioral Finance, imagine you are looking to buy a house in a prime area for your own residential use. You checked out the price of recent transactions for nearby units and also heard from your property agent that price is going for $1000 per square feet (psf). Having this price level in mind, you started searching for a unit that fits your preference. Being highly efficient, your agent immediately found 1 that matches all your requirements. Near a bus and MRT interchange that also have an integrated mall, within 1km of a prestigious school, have amenities like a swimming pool, gym and function room, age of the house is less than 10 years and the unit is very well maintained with friendly neighbors.The asking price of the owner is $1100 psf, slightly higher than the price you have in mind. So you hesitated and wanted to look around, believing that there must be some other units that fit the price you are willing to pay. But who knew that the property market started to boom and houses within the area started changing hands for as high as $1300 psf. You ran with your tail between your legs to the owner, begging him to sell for the original asking price of $1100. Knowing the market as well as you, the owner is now asking for the median price of $1300.

For fear that the price would go up again, you grudgingly accepted the price and bought the house. However, the property market started becoming a bubble due to the momentum of ever rising prices. When the government raised the interest rates to rein in the bubble, for months property transactions dropped to a miserable level. The same unit within your area is now asking for $800 psf and there were many distressed sale due to the inability to service mortgages in the high interest environment.

Let's look at some facts here, the fundamentals of the house that you bought had not changed much, the integrated interchange is still there, school is still within 1km vicinity, the amenities are still available, and the house is likely to be still less than 10 years old. The only things that could have changed were perhaps the neighbors. Nonetheless, why was it that you had initially only been willing to pay $1000 psf for it, only to accept $1300 psf a few months later? And if you were desperately in need to sell the house due to mortgage issues, you would probably accept the price of $800 psf.

Nothing has inherently changed for house to warrant such price differences in the short time span.

The above illustration is an example of what is happening on the stock market daily. The price that we are willing to pay for an asset changes not because of the changes in the asset's fundamentals, but because of the 1001 behavioral traits that we exhibit as human beings.

The Guru

Recently, I finished reading the book <Behavioral Finance - Insights into Irrantional Minds and Markets> by James Montier. James is a proponent of Behavioral Finance, a value investor, and member of the asset allocation team of Boston-based GMO. In this book, James laid out the various phenomenons of stock market that defied the EMH and showed high correlation to human behavioral traits.

Recently, I finished reading the book <Behavioral Finance - Insights into Irrantional Minds and Markets> by James Montier. James is a proponent of Behavioral Finance, a value investor, and member of the asset allocation team of Boston-based GMO. In this book, James laid out the various phenomenons of stock market that defied the EMH and showed high correlation to human behavioral traits.In this post, I shall be condensing a list of market phenomenons from the book for my own reference on the general directions that a company's stock price would take after certain event has happened. This should not be used as an absolute indicator.

Human Bias

- Over-Optimism

- Illusion of Control: Feeling that randomness can be controlled

- Self-Attribution Bias: Success attributed to Skills and Failure attributed to Bad Luck - Over-Confidence

- Men tend to be more over-confident than females: results in more excessive trading that translates into losses - Cognitive Dissonance

- Self-Denial: mental state of rejection to reduce or avoid mental inconsistencies - Confirmation Bias

- Finding and only accepting information that validates current belief or assumption - Conservatism Bias

- Clinging to an established position: difficulty in accepting that the Earth is round after believing it to be flat for years - Stock market tends to under-react to fundamental information like dividend omission, initiation or earning reports

- Stocks with earning surprises outperforms the market by 2%

- Availability Bias

- Assessing the probability of an event by the ease with which instances or occurrence can be brought to mind - Selecting stocks based on influence of media or broker research

- Stocks with high media coverage under performs in the next 2 years

- Ambiguity Aversion

- Fear of the unknown - 70 - 90% of total equity investments remain at home country where one is most familiar

- Fund managers are consistently more optimistic about their home markets than foreign market

- Narrow Framing

- The way in which you frame the question is pivotal to the answer - Investors and analysts have allowed themselves to focus on earnings that the corporates have wanted to report rather than earnings they are forced to report

- Pro-forma earnings (1) > US GAAP (0.47)

- Prospect Theory

- How decisions are actually made - Loss aversion: Even market pros sell their winners too soon and ride their losers too far

- Dynamic Prospect Theory

- Risk perceptions change dependent on prior returns - Investors are willing to expect less returns for accepting risk in a good market

Barriers to an Efficient Market

- Index Funds can drive stock demand/supply to irrational levels

- Inclusion or removal of stock from an Index forces index funds to perform trades to maintain its composition

- Stock purchases increases demand and pushes price up, while massive sell off from the funds drives prices down even without any changes in the fundamentals of the stocks

- Price differences between 2 almost identical assets can be far wider than the transaction costs involved

- Twin Securities / Dual Listed Equities showing illogical divergence in prices

- Market sentiments matter more than fundamental price for equities

- Price divergence between original company and the aggregate of split company when earnings are essentially the same but belong to different industry in nature

- Equity Carve Outs / Partial Spin-Off / Split Off IPO

- Companies with names associated with the Internet during the dot com boom experience higher valuation despite little correlation with the Internet business

- Companies with stock codes similar to a market superstar being mistaken for the incumbent can experience spike in prices for no reason

- Arbitrage is Not Risk Free Profit

- Fundamental Risk: Arbitrageur may be wrong about the position

- Financing / Noise Trader Risk: Uncertainty over resale value of assets due to irrationality

- Horizon Risk: Unknown period for prices to converge

- Margin Risk: Forced reduction of position due to margin calls

- Short Covering Risk: Availability of free-float affects ability to short a position

- Principal - Agent Problems

- Difficulty for principal in identifying good arbitrageurs results in capital constraint

- Principal pulling funds from agent when positions temporarily turned sour, right before the arbitrage is profitable

- Agents lack diversification due to specialization and risk aversion

- Force of Noise Traders

- Trades based on anything but fundamentals

- Positive Feedback Trading used by noise traders seeks to buy stocks after it has went up and sells after it goes down exhibits trend chasing behavior

- Overpriced stocks are pushed higher, vice versa for panic selling when price falls

- Disrupts profitability of arbitrage, perpetuating the survival of their trading methodology, no matter how unorthodox

- By rationally exploiting irrational behavior, George Soros' strategy of buying with expectation that other poorly informed investors would continue to enter the market paid off more handsomely than shorting and waiting for correction

Drivers of Various Investing Styles

- Investing Styles

- Small Cap vs Large Cap

- Index Tracker vs Active

- Value vs Growth

- Stocks vs Bonds

- Herd Movements

- Fundamentalists identifies a style that outperforms other competing styles and move money based on the drivers of the style

- Switchers observe the price effect of the flow created by best performing styles in recent past and jumps on the bandwagon

- A wide following soon follows, which propagated the rise of more funds adopting the style

- Style matures when it is firmly embedded in investor's psyche

- Decay sets in as bad news on prevalent style is released and/or good news on fundamental of competing style is becoming popular

- The cycle repeats with switchers jumping bandwagon

- Styles Rotation

- Movement of the herd causes unbalanced price level of stocks among stocks that fall within and without the prevalent style as a result of fund flows.

- Human bias are the drivers of the momentum life cycle (Over-reaction to unreliable information and Under-reaction to reliable information, Over-confidence and Self-attributing bias generating momentum reversal)

- Momentum trading (3 - 12 months) works for early stage winners and losers

- Contrarian strategies (3 - 5 years) works for late stage winners and losers

- Use of Quantitative Screens to eliminate bias

- For Value stocks, search for low price-to-book, low volume, long history of disappointment AND starting to deliver good news

- For Growth stocks, search for high price-to-book, high volume, long history of exceeding earnings expectations AND starting to deliver disappointing news

- Market Signals

- Dividend Payout Ratio (DPR)

- Bottoming of DPR represent strong recent earnings, increase odds of weak future earnings

- Value outperforms after DPR has bottomed (dropped from a period of high)

- High DPR represents weak earnings, increase odds of improving economy and earnings outlooks

- Growth outperforms when DPR troughs (turning up after a period of lows)

- Initial Public Offering (IPO) / Seasoned Equity Offering (SEO)

- IPOs tend to outperform on its launch date but under performs over subsequent periods

- Periods with high amount of IPO signifies that the market is overvalued and possibly running up to a bursting of bubble

- Mergers and Acquisition (M&A)

- High number of M&A via stocks implies that stock valuation is overpriced, similar to IPO, clustered activities of M&A signifies an overpriced market

- Insider Trading

- Irregular purchases of stocks by insiders generally imply that the stock will outperform in the subsequent period

Intrinsic Value of Stocks

- Market bubbles are the result of market participants' mindset

- Most investors exhibit 0 - 3 levels of reasoning whereby even if all of them thinks that a crash is coming, they don't iterate their thinking back to the present. They guess that others will sell a couple of steps before the crash, and plan to sell just before that happens.

- Speculative Bubbles are more likely to occur when:

- Significantly more inexperienced traders than experienced traders

- Greater uncertainty over fundamental value

- Significant payoff despite a very small chance

- Ability to buy on margin

- Difficult to execute short selling

- The only true valuation measure is Discounted Cash Flow

- Absolute Valuation > Relative Valuation

- All relative valuation (e.g. PE/G) are subjected to human bias that aims to make the derived value more attractive.

- Anchoring is the most deadly bias when using relative valuation

- Results in Over-confidence and Over-optimism

- Use Cash flow to avoid Narrow Framing

The checklist goes on but the rest of the concepts covered in the book is beyond my comprehension at the moment, so I shall not pretend that I understood them. Nonetheless, what I have condensed shall serve as my warning beacon while I tread the perilous journey of investing.

Conclusion

Investing in the stock market is more than knowing the fundamentals and being right all the time. Sometimes, knowing why things don't go the way they are supposed to, helps you to exploit the inefficiencies of the market and make profits out of those who are irrational. By keeping my own human bias in check, I shall keep my ears tuned to the market signals that spells opportunity. Equipped with tools that I have collected, faith in my chosen style, patience with my execution and courage to brave temporary set backs, I shall work hard and progress towards my desired end.

Thank you for reading. If you have any comments or feed backs, please post them in the comment section below or drop me an email at ohhanwee@gmail.com.

Conclusion

Investing in the stock market is more than knowing the fundamentals and being right all the time. Sometimes, knowing why things don't go the way they are supposed to, helps you to exploit the inefficiencies of the market and make profits out of those who are irrational. By keeping my own human bias in check, I shall keep my ears tuned to the market signals that spells opportunity. Equipped with tools that I have collected, faith in my chosen style, patience with my execution and courage to brave temporary set backs, I shall work hard and progress towards my desired end.

Thank you for reading. If you have any comments or feed backs, please post them in the comment section below or drop me an email at ohhanwee@gmail.com.

Disclaimer

I do not own any of the images used in this article.

This publication is for general reading only. The information and materials contained on this web site are subject to change without notice, are provided for general information only and should not be used as a basis for making investment decisions. It does not form part of any offer or recommendation, or have any regard to the investment objectives, financial situation or needs of any specific person. Before committing to an investment, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and read the relevant product offer documents. I am not liability and will not be liable for any loss or damage arising directly or indirectly (including special, incidental or consequential loss or damage) from your use of this web site, howsoever arising, including any loss, damage or expense arising from, but not limited to, any defect, error, imperfection, fault, omission, mistake or inaccuracy with this web site, its contents or associated services, or due to any unavailability of the web site or any part thereof or any contents or associated services.

This publication is for general reading only. The information and materials contained on this web site are subject to change without notice, are provided for general information only and should not be used as a basis for making investment decisions. It does not form part of any offer or recommendation, or have any regard to the investment objectives, financial situation or needs of any specific person. Before committing to an investment, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and read the relevant product offer documents. I am not liability and will not be liable for any loss or damage arising directly or indirectly (including special, incidental or consequential loss or damage) from your use of this web site, howsoever arising, including any loss, damage or expense arising from, but not limited to, any defect, error, imperfection, fault, omission, mistake or inaccuracy with this web site, its contents or associated services, or due to any unavailability of the web site or any part thereof or any contents or associated services.